At Trading Trophy ™, we are always looking for ways to help traders improve. That’s why we are excited to announce our new partnership with Edgyx, a smart trading journal that uses artificial intelligence to analyze your trades and your trading psychology.

Discover Edgyx here

In 2026, keeping a trading journal is no longer optional, it’s your most powerful tool to move from amateur trader to disciplined, profitable trader.

As part of this partnership, we have created exclusive offers for our communities:

-

All Edgyx users receive 20% off their Trading Trophy ™ orders, perfect for celebrating your trading milestones with a premium trophy or certificate.

-

All Trading Trophy™ clients receive 20% off the Edgyx Premium monthly plan for their first year, giving you advanced analytics, AI coaching, and smarter trade management.

What is a trading journal and why it matters

A trading journal allows you to document every trade, including not just your profits and losses, but also:

-

Technical data: entry point, stop loss, take profit, position size

-

Market context: trend, volatility, economic events

-

Emotional state: confidence, stress, FOMO, fear

-

Reasoning: why you took the trade

-

Post-trade analysis: what you learned

By keeping this record, you can identify strengths and weaknesses and avoid repeating the same mistakes.

Seven key reasons to keep a trading journal in 2026

1. Identify recurring mistakes

Without a journal, you risk repeating the same mistakes over and over: overtrading, revenge trading, exiting winning trades too early.

With Edgyx, you can automatically detect patterns that negatively affect your performance.

2. Understand your trading psychology

Psychology accounts for up to 80% of trading success.

A journal helps you spot emotional biases and understand how your mindset affects your decisions.

With Edgyx’s AI coach Ora, your emotional patterns are analyzed in real-time, giving personalized guidance for improvement.

3. Measure your performance objectively

A trading journal lets you calculate key metrics:

-

Win rate

-

Risk/reward ratio

-

Profit factor

-

Maximum drawdown

-

Expected value

These numbers give a clear and objective view of your strategy’s long-term profitability.

4. Refine and optimize your strategies

By reviewing past trades, you can identify:

-

Your most profitable setups

-

The assets or pairs you perform best on

-

The most effective trading hours

-

Market conditions that suit your style

Edgyx’s AI accelerates this process by highlighting winning patterns and areas to improve.

5. Develop discipline

Knowing that every trade will be documented naturally makes you more disciplined.

The journal creates personal accountability, essential for long-term trading success.

6. Build data-driven confidence

Seeing hundreds of documented trades allows you to navigate drawdowns calmly.

Your journal becomes your emotional anchor during challenging periods.

7. Accelerate your learning curve

Documenting and analyzing each trade helps you progress 3–5 times faster.

Every mistake becomes a lesson, every success a blueprint to replicate.

Excel vs dedicated apps: the advantage of edgyx

Limitations of Excel

-

Manual entry is time-consuming and error-prone

-

No automatic broker synchronization

-

Limited analysis without advanced formulas

-

Hard to add screenshots or track psychology

Advantages of Edgyx

-

Automatic sync with MT4, MT5, and cTrader

-

Instant calculation of all key metrics

-

Visual dashboards and charts

-

Screenshots and annotations integrated

-

AI analysis of psychology and trading patterns

In 2026, AI is transforming trading journals. Ora, Edgyx’s AI coach, guides you in real-time, detects mistakes before they happen, and helps you progress faster.

Exclusive partnership offers:

-

Edgyx users: 20% off Trading Trophy™ orders

-

Trading Trophy™ clients: 20% off Edgyx Premium monthly plan for the first year

How to keep your trading journal effectively

Before each trade: note your emotional state, document your reasoning, and define your full plan.

During the trade: capture charts, record deviations and emotions.

After the trade: analyze successes and mistakes, and note what you would do differently.

Weekly review: spot recurring patterns and set goals for improvement.

Conclusion: 2026, the year of documented performance

Keeping a trading journal is no longer optional, it’s an investment in your trading career.

With modern tools like Edgyx and Ora, documenting, analyzing, and improving has never been easier or more powerful.

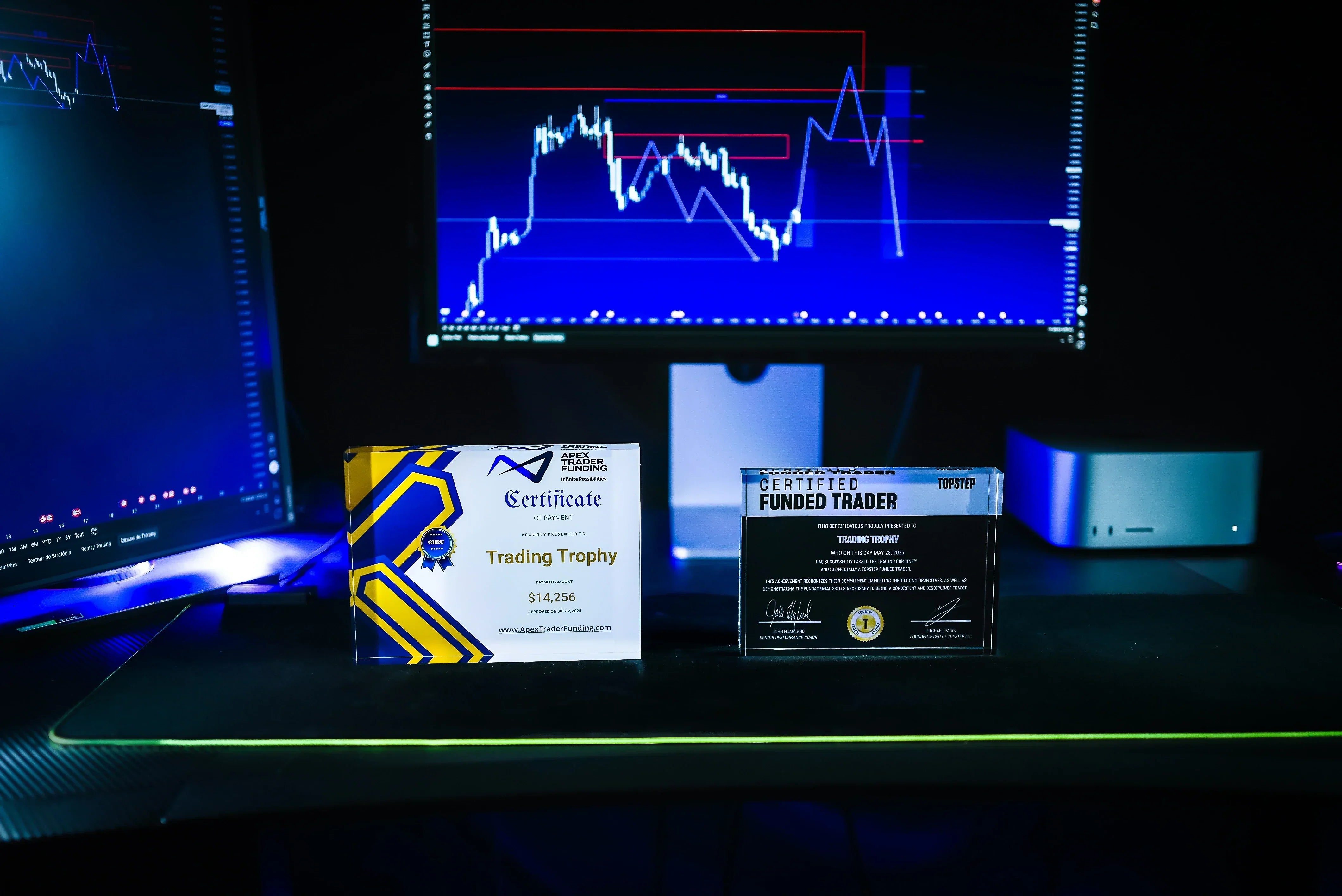

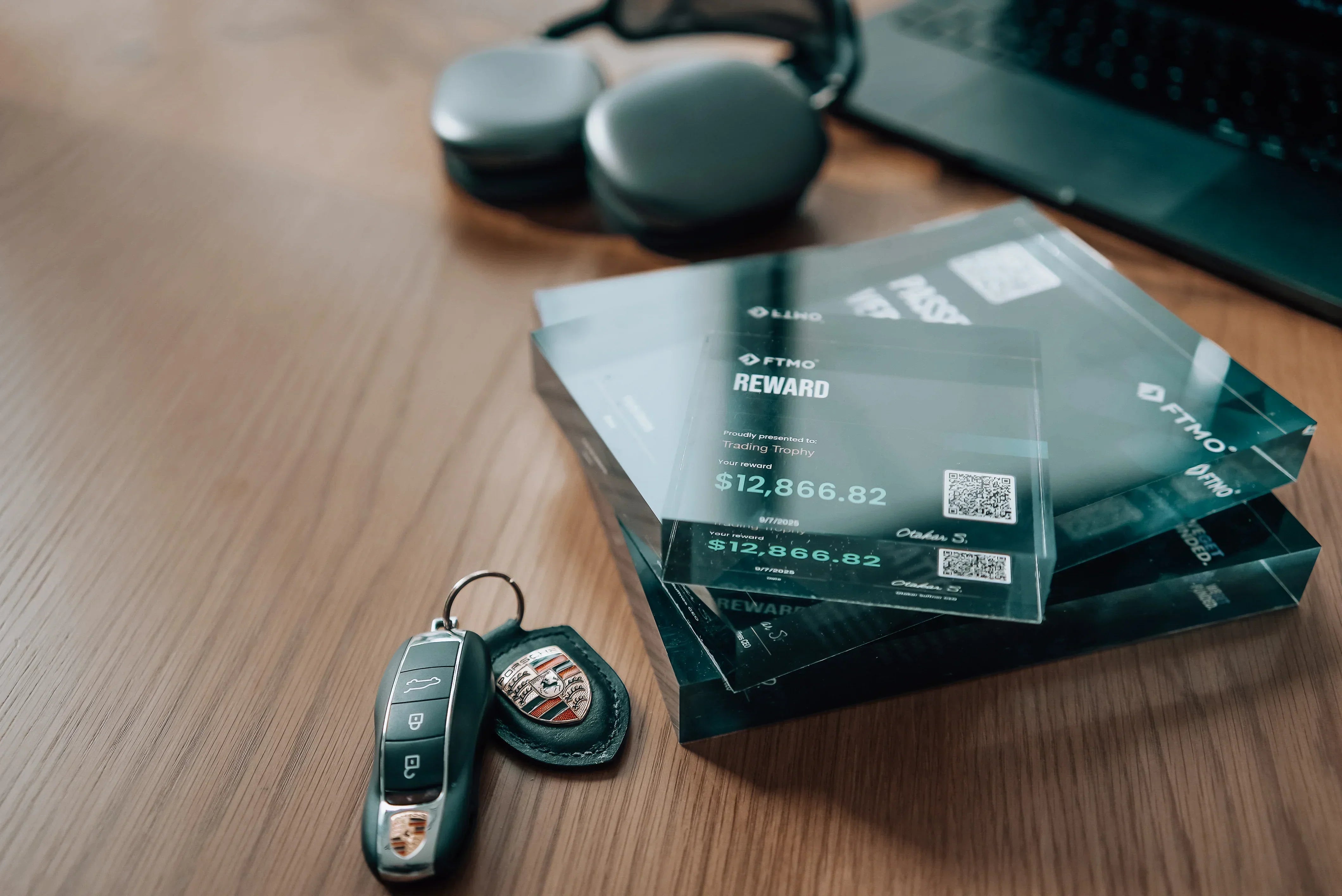

At Trading Trophy ™, we believe every achievement deserves to be celebrated. Combine your trading discipline with our collection of trophies and certificates and take advantage of our exclusive partnership: Edgyx users get 20% off Trading Trophy™, and Trading Trophy™ clients get 20% off Edgyx Premium monthly plan for their first year.

Don’t let mistakes repeat in the shadows. Celebrate your trading achievements with Trading Trophy ™ today.

Upload your certificate now

Why most funded traders lose their accounts and how to stay funded long term